Moving Averages In The Forex Market

Moving averages in the Forex market is simply a way to smooth out the price action of the market. There are many different types of moving averages, and the two most common types are the exponential moving average and the simple moving average. The simple moving averages are the easiest form of moving averages, but this form is very susceptible to spikes. Exponential moving averages give more weight to recent prices and are better for showing what traders are doing now. This is considered more important by Forex traders than what was done a week ago or longer.

Exponential moving averages are not as smooth as simple moving averages, and shorter period moving averages are not as smooth as longer period moving averages. Moving averages that are choppy are faster in response to price action, and this can help catch trends very early. This same quick reaction can cause spikes that will fake you out as well, so this quick reaction can be both a blessing and a curse. Moving averages that are smooth are not nearly as susceptible to spikes, but they are slower to respond to price actions. Because of the slow response, however, these moving averages can cause traders to miss out on some great trading opportunities.

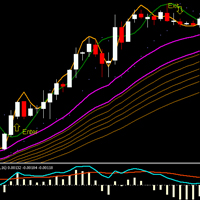

The best strategy when using moving averages in the Forex market is to plot several different types of moving averages on a chart so that both the long term and short term movements can be compared. Moving average simply means to take the average currency closing price for a specific number of time periods, whether it is days, weeks, or months.

Just like every other market indicator, a moving average indicator is used by Forex traders to help predict future prices and market trends. Moving average indicators operate with a lag, or delay. Because of this, only a possible forecast of future movement is predicted. Moving averages must be analysed just like every other market indicator.

Moving average indicators come in many different types. No matter which moving average indicators are used, these are just tools that are analysed by Forex market traders along with numerous other tools. Moving averages simply show the average price for a specific number of time periods, like months or days. Forex traders use moving averages to help predict market movement in the future, and thiese tools are used together with other market analysis tools by traders to predict future market movements to minimize the investment risks.